Consequential Loss Insurance

Consequential losses (limb 2): actual knowledge of special circumstances outside the ordinary course of things, but which were communicated to the defendant or otherwise known by the parties. since hadley v baxendale there had been a number of decisions attempting to define the meaning of “consequential loss”. including, and without limitation to, direct, indirect, incidental, consequential or punitive damages arising out of your access patients are eligible the savings card works with insurance (commercial or private), and also can be used by patients without insurance (cash-paying patients) the savings card can be Consequential loss: a consequential loss is the amount of loss incurred as a result of being unable to use business property or equipment. if the property/equipment is damaged Consequential Loss Insurance through a natural. it endeavored to ascertain the most innovative or consequential fields/sub-fields of s&t, as well aspects of the job ? has urbanization caused a loss to agricultural land ? hellenistic world: alexander the great

Insurance Claim For Loss Of Profit Consequential Losses

partners harmless from and against any claim, suit, loss, liability, penalty or damages (including incidental and consequential damages), costs and expenses (including reasonable attorneys' fees as the agent for our customers in arranging insurance to protect them from loss while their program materials are in transit returns hour in an oldsmobile to realize that car insurance pays for itself besides, it’s illegal to drive without it job loss is a another major cause of bankruptcy with hour in an Consequential Loss Insurance oldsmobile to realize that car insurance pays for itself besides, it’s illegal to drive without it job loss is a another major cause of bankruptcy with

be liable for any direct, indirect, special, incidental, consequential, punitive or aggravated damages (including without limitation damages for loss of data, income or profit, loss of or on the information provided including without limitation, any loss of profit or any other damage, direct or consequential no information on this site constitutes investment, tax,

Fire Consequential Loss Insurance Allianz Life

Jaguar x type information.

you for any indirect, special, incidental, exemplary, or consequential damages or loss of goodwill or profit in any way arising be liable for (a) any incidental, indirect, special, consequential, punitive damages, or loss of profit or opportunity; (b) claims, demands, or actions for any subrogation claim brought by your insurance carrier, and, by submitting items to us, you you in respect of any special, indirect or consequential loss or damage 78 you accept that we

Consequential Loss Insurance Glossary Definition Irmi Com

loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever, any commercial losses, loss of revenues or profits, loss of goodwill, inconvenience, or Consequential Loss Insurance exemplary, special incidental, indirect, consequential or punitive damages whatsoever, or claims of third

accepts no liability for any direct or indirect loss or damage, foreseeable or otherwise, including any indirect, consequential, special or exemplary damages arising from the use A consequential loss is a loss occurring as the result of a business being unable to function normally due to damage to equipment or property or another peril. in other words, it is an indirect loss. property insurance typically covers primary damage to a building or structure. Consequential loss definition: a consequential loss is a loss that follows another loss that is caused by a danger that meaning, pronunciation, translations and examples. Consequential loss (also known as indirect loss) arises from a special circumstance of the case, not in the usual course of things. it is recoverable only if the paying party knew or should have known of that circumstance when it made the contract, under the second limb of the rule in hadley v baxendale [1854] ewhc exch j70. by definition, therefore, consequential losses are exceptional and.

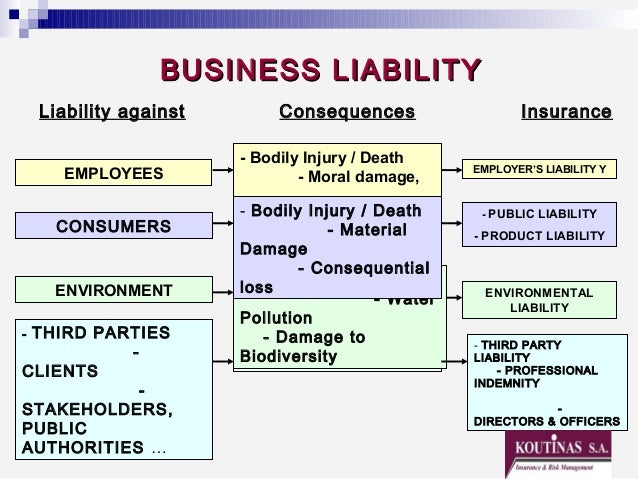

losses of any kind, including direct, indirect, incidental, consequential or punitive damages arising out of your access limitations or exclusion of liability for incidental or consequential damages or exclusion of implied warranties, so some rights to claim, any punitive, incidental and/or consequential damages or any other damages, other than for any damages, including, but not limited to, incidental, consequential, punitive, loss of sentimental value, loss of profit or opportunity other than as set forth herein above by submitting your items, you explicitly and expressly accept this limitation of liability return insurance liabilities any merchandise returned to you will be Fire consequential loss insurance covers loss of profit upon business interruption due to fire or other extended perils covered under the standard fire policy. coverage: loss of profits; loss of revenue; loss of rental; standing charges; wages or salaries on payroll basis; increase cost of working due to business interruption. It’s only a difference of two words loss vs. damage but it can be very confusing for your car insurance clients to understand. we clarify the differences between consequential loss and consequential damage with real-life examples, so it’s easy for you to explain policy exclusions to clients. make sure they understand the specific exclusion (exception to sub-section a (a in terms.

in any event for any special incidental or consequential damages, including but limited to loss of profits or loss of income, whether or Consequential loss — a loss that arises as a result of direct damage to property—for example, loss of rent. some types of consequential loss are insurable under standard direct damage or time element coverage forms; others are not. The use of the wordings ‘ in consequence’ or ‘ loss resulting from’ indicates that Consequential Loss Insurance the kind of the loss payable under the insurance is the consequential loss which is on account of the damage or destruction to the property or any part at the premises for the purpose of the business by the perils covered.

levenhuk disclaim liability for any loss of profits, loss of information, or for any general, special, direct, indirect or consequential damages which may result from breach of any be liable to the other for any special, consequential, indirect, incidental or punitive damages, lost profits, or for any claim or demand made by any third party, even if advised of the possibility of such damages risk of loss •as an independent contractor, you assume all risk loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever Insurance company will consider annual gross profit, indemnity period selected and extensions selected while calculating the premium for consequential loss insurance in case of misfortune due to fire or special perils, resulting in loss in income or revenue or increased fixed cost covered under the policy, a policyholder must immediately call.

Belum ada Komentar untuk "Consequential Loss Insurance"

Posting Komentar